Introduction to the 2025 Regulatory Review

On the 21st February 2025, the Ministry for Regulation (MfR) announced a comprehensive review, and their press release mentioned a commitment to work “with MedSafe and the Ministry of Health (MoH) to reassess these nearly twenty-year-old regulations.” A reassessment of the regulations is a form of review, but will likely be limited to only the secondary legislation focusing on the iHemp regulations.

In January 2025, MfR officials sent a briefing document (which contained many of the issues facing the industry) to Minister Seymour (CCed to Ministers of Health, Police, Agriculture, Food Safety and Horticulture) outlining 3 approaches.

On the 9th of April, MfR confirmed to the NZHIA that the Minister has considered the advice from his officials and has “agreed in principle” to Approach 1. Therefore, the review will be limited to looking at the secondary legislation, i.e. our industrial hemp regulations.

Approach 1: Changes through secondary legislation – MODA’s regulation-making powers could be used to reduce or remove licensing requirements.

Approach 2: Industrial Hemp Regulatory Review (recommended by officials) – A regulatory review to generate more benefits for the sector than targeted changes, covering getting out of MoDA, full plant utilisation and consideration of the 5 Objectives in our Hemp Industry Strategic Proposal for Regulatory Change document.

Approach 3: A combination of the above, changes through secondary legislation in advance of a regulatory review.

This is very disappointing, as considerable work had already been done, which would have been useful had Approach 2 or 3 been adopted. The NZHIA and Coalition partners have written to the Minister asking him to reconsider and add iHemp to the review timetable. As this approach would include the objectives in the “Hemp Strategic Proposal for Regulatory Change as at 21 May 2025 we have not received a response.

The following was taken from email to NZHIA on 23/4/2025;

The briefing paper notes under Approach 1 points 10-16 “There is likely minimal non-compliance within the current system” “This likely low level of non-compliance indicates that there is a strong case to rationalise or potentially remove the current licencing requirements to ensure that the costs imposed are proportionate to the current levels of risk”, “These changes could be implemented within months through an Order in Council”. “There are risks with this approach and it may not meet the sector’s expectations” related to ACVM, supplying to Medicinal Cannabis industry and accessing natural health and nutraceutical markets.

“Following further engagement with the sector and relevant agencies, officials have identified three approaches for deregulating or reducing regulatory requirements on the industrial hemp sector. Targeted changes to secondary legislation to permit cultivation and dealings with industrial hemp without a licence could be completed within months through the regulation-making powers within the Misuse of Drugs Act 1975. However, this approach would not address the wider regulatory changes the hemp sector is advocating for, which span licencing, interactions with other regulatory systems, and changing regulatory practice”.

See below for: Progress and timeline, extracts from the briefing to Ministers 9 Jan 2025, the review in relation to the strategic proposal for regulatory change, supporting documents, reference links and media links

Progress and Timeline

Timeline

23 May 2025: Members Update providing feedback on adoption of Approach 1

29 April 2025: Email to Minister Seymour – reconsider and go with Approach 2-3

9 April 2025: Response received from MfR regarding the scope of the review – cover letter and briefing to Ministers

24 March 2025: Field and Factory Visit

21 February 2025: MfR Announcement – Industrial Hemp Regulations to be reviewed

20 February 2025: PPSC briefing from MOH and MOPI

21 November 2024: NZHIA presentation to PPSC

November/October 2024: Various meetings with supportive MPs/Ministers and relevant ministries

Extracts from the briefing by MfR officials to Ministers for Regulation, Health, Police, Agriculture, Food Safety and Horticulture

This approach would have required additional consultation with relevant ministers 21, but it was noted at 20 “A significant amount of analysis has already been undertaken by MfR and other agencies into industrial hemp which should streamline the review process”.

Other relevant Extracts from the briefing by MfR

How does this ‘reassessment’ of the regulations (not a review) fit in to the Strategic Proposal for Regulatory Change document

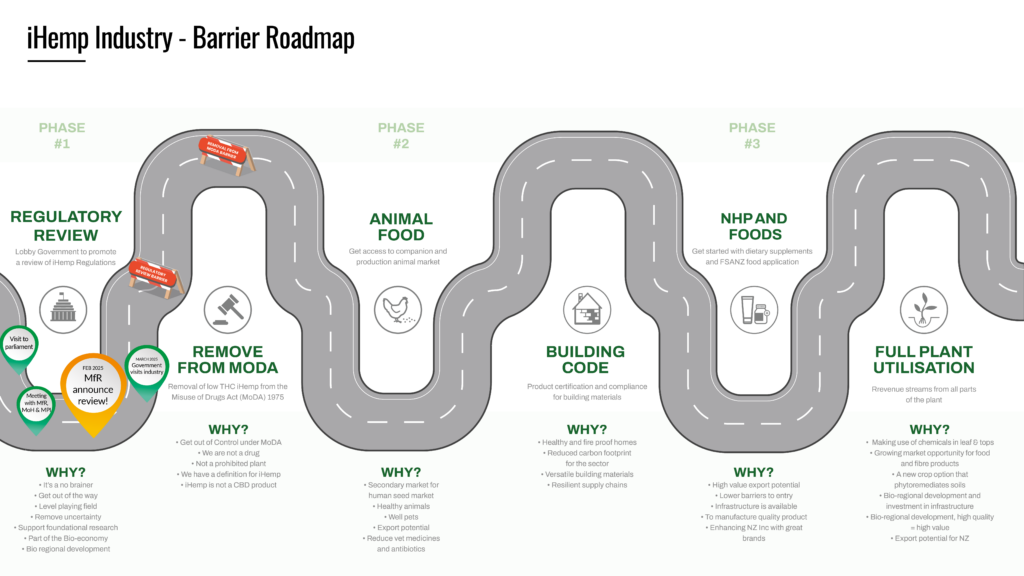

The original 5 Objectives (put forward by the coalition of NZHIA, Aotearoa Hemp Alliance and NZ Medicinal Cannabis Council) of our “Hemp Industry Strategic Proposal for Regulatory Change” document, which are accounted for in the Ministry for Regulation briefing document and remain relevant as follows;

- Ease regulatory burdens on iHemp growers and processors.

- Open commercial and regulatory pathways for the domestic supply of New Zealand iHemp products for animal nutrition.

- Open commercial and regulatory pathways for New Zealand iHemp-derived Cannabinoids, by allowing the supply of iHemp-derived Biomass (Leaves and Flowers) produced under an Industrial Hemp Licence to a Medicinal Cannabis Licence holder.

- Open commercial and regulatory pathways for New Zealand iHemp-derived Biomass (Leaves and Flowers) to be processed into non-psychoactive cannabinoid, terpene and flavonoid iHemp products and to be sold as a dietary supplement/ natural health product.

- Integrate iHemp as a carbon sequestration offset of farming emissions within the He Waka Eke Noa framework.

The proposal document outlines the magnitude of change that each of these Objectives would bring to our sector, and while the removal of the regulatory burden that we have identified in Objective 1 is important, it has the lowest expected positive impact for our sector when comparing to Objectives 2 to 5, all of which appear to be excluded from Minister Seymour’s preference for “Approach 1”. “Approach 1” would appear to consider only a portion of the potential Regulatory change that were identified for Objective 1 alone, with the removal of iHemp from the Misuse of Drugs Act 1975 being an obvious example.

In comparison to our Objective 1, let us also consider Objective 3 – biomass for medical use and Objective 4 -supplements/Natural Health Products. In contrast to our current regulatory settings, in 2024 the USA realised US$417 million in revenue for iHemp grown outdoors, with US$386 million (approx. 93%) of this revenue generated by the sale of Floral Hemp or “Leaves and flowers” (as per Statistics released April 17, 2025, by the National Agricultural Statistics Service (NASS), Agricultural Statistics Board, United States Department of Agriculture (USDA)). In comparison, the supply of these parts of the iHemp plant is currently constrained in New Zealand within the Misuse of Drugs Act 1975 and the Medicines Act 1981, and represents a significant growth opportunity if these regulatory settings were to be amended.

Furthermore, let us also consider our Objective 2. As mentioned prior, all of the Coalition groups and many NZHIA members were directly involved in submissions for the recent Agricultural and Horticultural Products Review relating to Hemp Products and Hemp Animal Feed. The final report from this review includes mention of iHemp (see page 24 of the attached Summary of engagement), which was also mentioned in the MfR Media communications in February. The exclusion of MPI ACVM from any immediate iHemp Regulatory review, therefore, appears to be contradictory and counter-productive.

Objective 4 – Supplements/Natural Health Products (5 star – out of 5 stars for magnitude of change) and Objective 5 – Carbon Offset (4 star), which along with Objective 3 – Cannabinoids and Biomass for Medical Cannabis licence holders (4 star), have been identified as having the greatest magnitude of change across our 5 Objectives. These and Object 2 – Animal Nutrition (4-star) will be out of scope of the reassessment of the regulations.

The NZHIA and coalition partners are following up on the out-of-scope objectives, independently of a review and will continue to work on them as part of achieving our #1 Objective, to get out of MoDA.

This is a further disappointment to the coalition after waiting 15 months for a cross-government response to our Hemp Industry Strategic Proposal for Regulatory Change document, which never arrived.

In short, the news of “Approach 1” is a handbrake on the significant progress we thought had been made in 2024/2025 with the “Comprehensive review” that was announced in February 2025.

Supporting Documents

Primary Production Committee Briefing – April 2025 – a “interium report” from the PPSC, feedback from the PPSC following the presentation by the NZHIA in November 2024 and the briefing they requested from MOH, MPI (including comments with MfR) links.

Official Information Request – NZHIA Response – 9 April 2025, the cover letter explaining the advice given to the Minister for Regulation, and the Ministers preferred option.

Briefing Paper MfR- Appendix 23 Jan 2025, the briefing paper given to the Minister for Regulation (9 pages) detailing the 3 approaches being considered, option 1.

Reference Links

Campaign links:

Press Release – 21 February 2025: The Biggest Breakthrough in a Decade!

The NZHIA 2024 Media Campaign – Part II : Lets get regulations changed to allow a new horticultural industry!

The NZHIA 2024 Media Campaign – Part I: iHemp is NOT a drug!

The NZHIA 2024/2025 Media Campaign Overview: iHemp needs to get out of MODA

Hemp Industry Strategic Proposal for Regulatory Change

Agricultural and Horticultural Products Regulatory Review (see page 24) Disappointingly, the NZHIA submission was not acknowledged in this document, but pleasingly, 6 hemp-related companies were

Background information:

Strategic Proposal for Regulatory Change

Dr Nick Marsh intro 2020: Watch via YouTube

Full Investor Report 2020

Snapshot Investor Report

Facilitating growth in the New Zealand Hemp Industry – Sapre

MBIE Report – Pg 98: 30 Opportunities